Philanthropy has been caught up like everything else this year in a pandemic that has outwitted just about everyone. The health crisis has raised shaming inequality and climate crises that markets and governments have been painfully slow to address.

Enter the ordinary individual you might say to hurry progress along.

Just as crowd sourcing has found its place as a direct and easy way to invest in companies and ideas, especially for younger investors, so are some corners of philanthropy seeing fresh momentum.

show that household giving and volunteering was up by more than 10 per cent for the year in response to the pandemic, but usual fundraising has collapsed.

Swiderski’s fledgling project materialised from years working as a fund manager and recognising that markets can’t solve everything, and certainly not at the pace needed now to tackle the climate emergency.

“Trustees may be constrained by fiduciary obligations and other investment restrictions but private individuals are not,” he said.

The group screened around 120 charities before settling on five to support initially. It scored each on their ability to draw down C02 and for their work in three climate areas: natural carbon solutions (protecting forests, planting trees, reducing pressures of deforestation); renewables (delivering clean energy to around a billion people who have no access to power at all); and advocacy (promoting good policy and enforcing existing environmental laws).

Investing “for good” has become a confusing minefield begging for some clarity. The industry has been flooded this year with ESG and green finance solutions that have bewildered investors and created enough room for greenwashing to drive a bus through.

So why wouldn’t a quality-assured tick-box approach to “re-investing in Earth,” as Swiderski likes to refer to his business aims, appeal to overloaded investors?

The group has taken its campaign directly to the public on a lofty journey of raising £10 billion annually but it also needs endorsement from financial institutions.

“If the message of what you need to do is coming from your IFA, your private bank, or wealth manager, it immediately normalises it,” Swiderski said.

“What we are doing is very much complementary to an ESG strategy but we also need to think about the banks we use," he said. "The big polluters, the fossil fuel companies and utilities, are debt financed, so it is banks and bond markets funding them, not share markets. If I sell my shares in Shell, which I did some time ago, that doesn’t affect Shell’s life. But if no-one lends money to Shell that really does change things,” he said.

In pre-launch pitches to fund and asset managers, comments ranged from "this is too hard to pass at board level", to "this is too costly to implement", to "is this something a client even wants?" Swiderski said, noting pushback in some wealth management circles. Others, he said, have since been back in touch expressing interest, though when pressed, he said it was too early to be naming them.

Whether the sector thinks it has climate change covered, through co-investing philanthropy projects or private capital pouring in at the direct company level, Swiderski argues that these are for-profit initiatives that may take years if not decades to roll out.

No time to waste

And we don’t have that luxury of time.

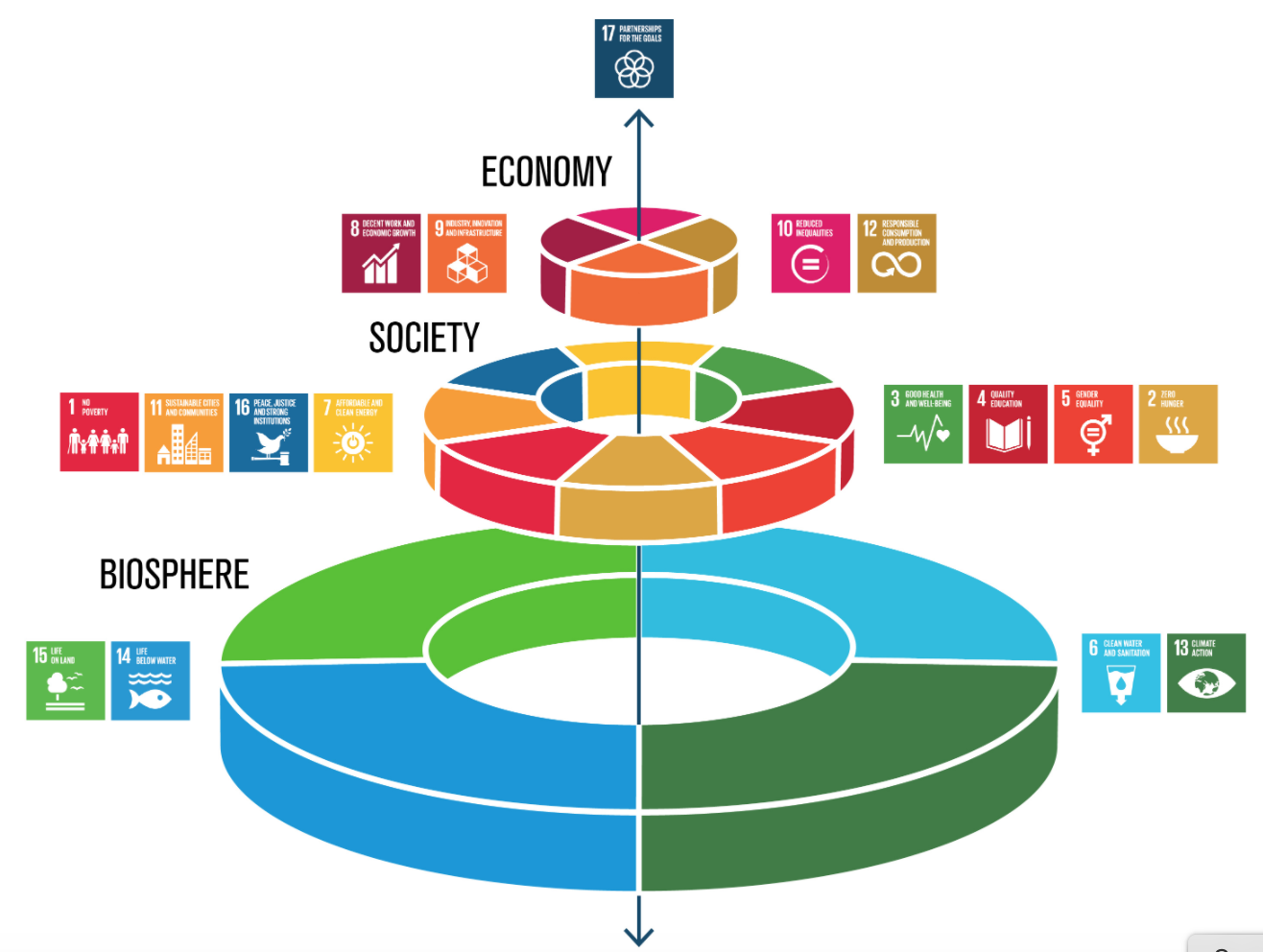

“There is no market solution for protecting rainforests. There is no fund you can invest in for suing coal fired power stations in Europe or advising the Chinese government on good environmental policy, which is the sort of work , a research arm of Stockholm University, has argued for this approach. (The schematic below shows how its chief scientists have re-worked the UN’s planetary goals to revolve mostly around food and in a different hierarchy).

“The four fundamental . The charity was spun out of a network of entrepreneurs, many of them technologists, who wanted to put their wealth to the best possible good while also creating a likeminded space to share progress. The group is known for publishing analytical reports on climate and lifestyle decisions and their impact on carbon emissions.

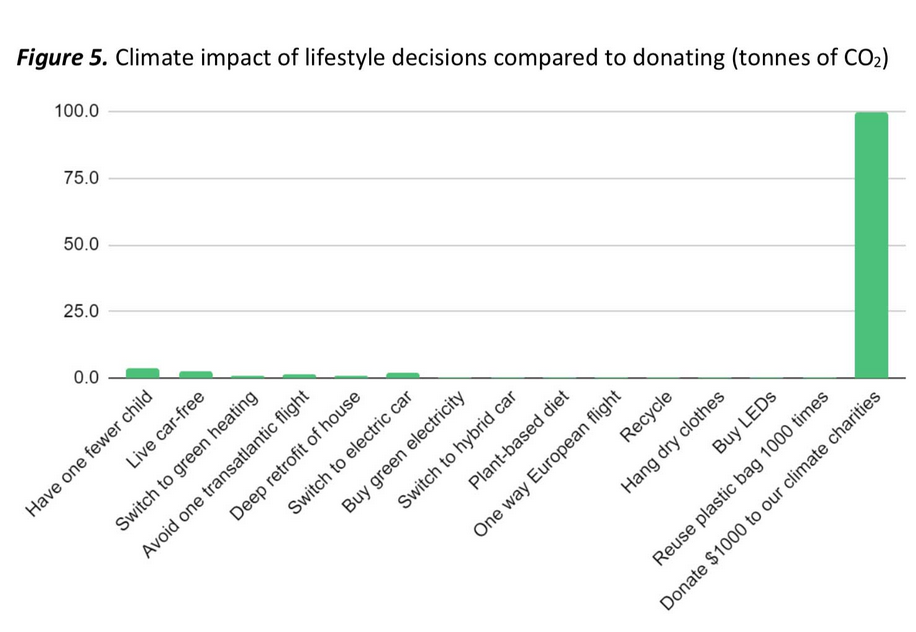

It has calculated that a typical person emits five to 20 tonnes of CO2 annually, and that giving to the most effective climate charities can abate a tonne of CO2 for the equivalent of a $10 annual pledge. It also examines the various trade-offs and unintended consequences of our lifestyle decisions, from choosing to eat chicken over beef to the effects of driving an electric vehicle in one economy over another. There are many artful nuances. It is especially attentive on the subject of “offsetting.”

The two climate charities the group recommends to a mainly entrepreneurial member base are the Clean Air Task Force and the Coalition for Rainforest Nations, with each running annual budgets of less than $8 million per year. “For this relatively small amount, they have each played a leading role in political campaigns which have had a huge effect on global climate policy,” Founders Pledge said. (See some of its research outlined in the chart below.)

Widening appeal

John William Olsen, who manages impact strategy for ’s virtual Davos gathering earlier this year, 120 of the world’s largest companies pledged to come up with a set of common metrics and non-financial disclosures to help stakeholders fix the ESG quagmire, with talk from CEOs about seizing an historic opportunity to rebalance the world for the benefit of all.

In updates to the commitment, the WEF wrote: “Since the project began, the ecosystem has seen numerous developments. The European Commission is revising its Non-Financial Reporting Directive. The International Organization of Securities Commissions (IOSCO) has set out its intention to accelerate the harmonisation of sustainability standards. The US Securities and Exchange Commission (SEC) has amended its rules to enhance human capital disclosures. The International Financial Reporting Standards (IFRS) Foundation has agreed to consult on broadening its mandate to include sustainability issues. The International Federation of Accountants (IFAC) has called for the creation of an International Sustainability Standards Board to sit alongside the International Accounting Standards Board (IASB) under the auspices of the IFRS Foundation. Meanwhile, the five leading voluntary framework and standard-setters – CDP, the Climate Disclosure Standards Board (CDSB), the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) – have for the first time committed to work towards a joint vision. They presented a paper to the IBC Summer Meeting 2020 and issued a subsequent statement of intent.”

This you might read is precisely the problem of galvanising an institutional response.

Nevertheless, those in the sector argue that financial institutions are best placed to fund the necessary research to cut through to the best market solutions.

“I completely agree that it is always good to do good analysis but there are many things that are very hard to quantify and therefore they suffer,” Swiderski says, offering examples.

Trees

“In the climate solutions area, everybody loves trees, you can see them, count them, work out how much CO2 they sequester if they sit there for the next 40 years and everyone can go away and do their spreadsheets.

"We know that marine environments are critical for the carbon cycle. We know that sea grass absorbs a tremendous amount of CO2, and that marine mammals by the amount they sequester in their bodies when they die are very good carbon absorbers. We know that kelp and mangroves are also a critical part of the carbon cycle, but all these are hard to quantify because they are in the sea. And because we can’t quantify them they are essentially being ignored.”

His explanation mirrors the current data paradox (and obsession) that if you can’t measure it does it even exist?

“Our selection processes are as analytical as they can be but you can’t compare somebody taking a Greek lignite miner to court, which Client Earth has done, forcing the Greek government to agree to phase out coal-fired power generation, to conserving an acre of rainforest."

Swiderski is a passionate advocate with a goal of getting 5,000 people to re-invest in Earth by the end of 2021.

“If we do that, it could represent giving in the area of several millions because obviously it is a function of how wealthy the people are. But it could raise £5 million to £10 million a year. Remember this in an ongoing commitment that people make, it is not just a one-off. The 100 we have so far have said that they are going to do this every year so it is a very high-quality commitment in that sense.”